Understanding Auction House Costs and Fees

When purchasing a car from Auction you need to consider the price bid (the hammer price) and the auction house fees (what they charge for using their service). Different auction houses charge different fees; some charging a flat rate no matter what the cost of the vehicle, others employing a sliding scale. Some auctions are open only to trade buyers that hold accounts with them, others have a separate range of fees for public buyers.

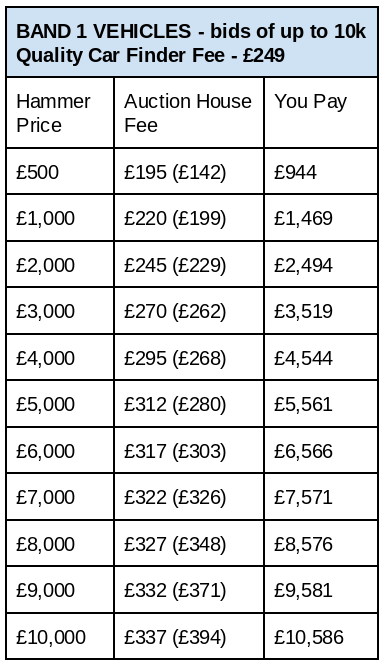

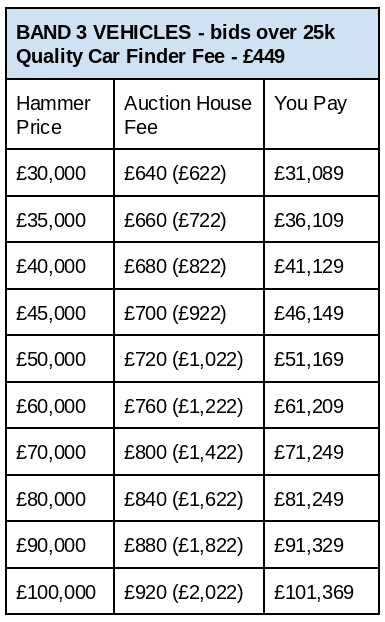

The majority of vehicles passing through auction do so via British Car Auctions and consequently they are our most commonly used means of sourcing cars. Below we’ve broken down purchase costs, showing ‘hammer price’ (i.e. the winning bid), preferential rate auction house fees that we would pay on that bid (with the saving you make against public rate shown in brackets), our fee, and total expenditure to secure the car. Typically, for any car with a hammer bid of £2,500 or over it is cheaper to employ our services than to attend that auction (where possible) and purchase the car directly.

We can never be entirely sure of the fees that the auction house will charge until we receive their invoice (which we will copy to you of course), but the figures quoted are based on recent fees charged and are quite accurate. Nonetheless, we advise factoring in a 10% variance (which can be an increase or a decrease) just to err on the side of caution.

Many auction houses charge for mechanical and/or condition reports and where we receive discounts we pass those on to our customers in their entirety. Some houses also charge the public for DVLA registration but where this is the case we will complete this for you free of charge and as such have included this figure in the savings outlined below.

BCA (British Car Auctions) Fee Structure

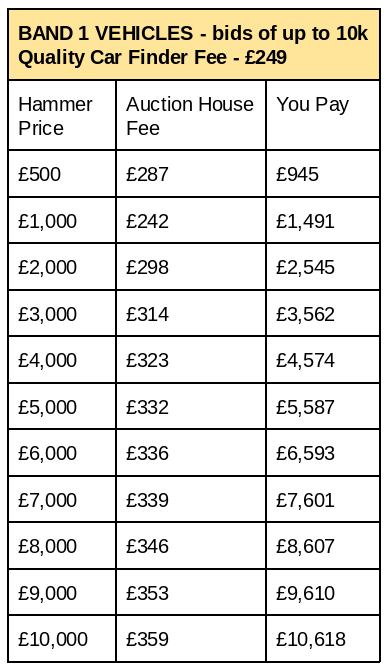

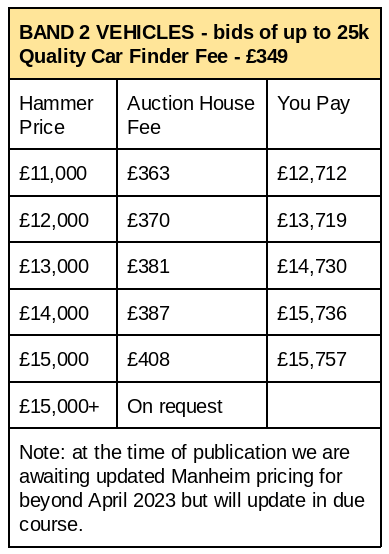

Manheim Fee Structure

Although somewhat smaller than BCA, Manheim Auctions usually have approximately 6,000 vehicles on sale at any one time and are also an excellent option when sourcing vehicles. Their fee structure is similarly stepped, but on more expensive vehicles is less staggered than BCA. These figures are provided by Manheim, allowing us to predict costs slightly more accurately than we are able to when purchasing through BCA.

Accurate Pricing

CAP (expected Car Auction Prices) gives us a good idea of the price that a car is likely to make at auction. These figures are made available to holders of trade auction buying accounts but not members of the buying public. We will always share CAP prices with you. However, CAP is only a guide based on average prices; when anticipating the price a car is likely to sell for we need to take other factors into consideration:

- Service history: a full history car (that is one that has been serviced every year), and especially one which has been serviced at a main dealer, can cost a lot more than one with no history.

- Condition: a grade 1 car (basically like new) will cost a lot more than a grade 4 car (which while perfectly acceptable to most people, will have a lot more signs of use). We don’t recommend purchasing a grade 5 car, but they are a far cheaper option if you’re working on a tight budget.

- Desirability: some makes and models are more desirable than others (be that for their reliability, drive or aesthetics) and consequently hold their value more strongly.

Desirability is traditionally the hardest factor to predict and in many cases can have the greatest impact on price. CAP is a useful tool, but it predicts a value based on historical data. To give a more accurate idea of pricing, we use market-leading analysis tools to see what the cars that interest you are selling for

this week

and how fast those makes and models are selling. By gaining a clearer understanding of current retail trends we can make the most of your budget, ensuring you’re a) getting good value and b) less likely to be disappointed by unsuccessful purchase attempts. A good (albeit quite extreme) example of this was a Porsche 911 that we recently sourced. CAP was £40,200, with a suggested retail price of £46,600. However, price indicators showed that an average example (and this was a grade 1 example with good history, so far from ‘average’) would fetch £58,000 retail. Although we did purchase an alternative 911 for the customer in question, this one fetched £9,000 over CAP and was not an appropriate option for him.